So, it’s official! We’re going to be launching our Lending platform soon!

Pending a few final checks, the FMA have confirmed they will be granting us our license. And, we’re stoked. Our entire team in fact, is stoked. Even our lawyers are pretty stoked (thank you, Buddle Findlay!!). Here’s the action shot when we announced the license looked likely to come through:

The man behind the platform

Our Rad Debtor, Barry Grehan (top right) has more reason than most to look so ecstatic.

He has been the driving force behind our licence application. He started skyping Anna back at the end of 2014, when he was planning his trip to New Zealand. His bold email really caught our attention (even though by then, we had hired Will for the role he wanted).

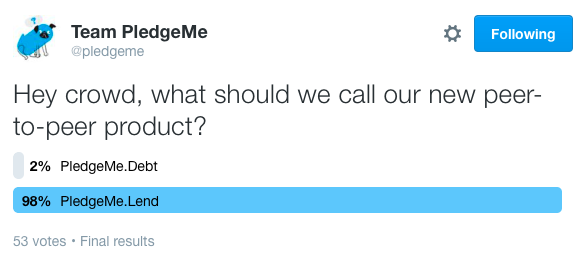

When Barry arrived in Wellington, he made Anna meet for a coffee and offered to research the crowdlending opportunity – both here in New Zealand, and internationally. As a reformed banker from Ireland, he had a wealth of knowledge around business lending and the questions to ask. That, coupled with his friendly nature and curiosity, meant he was able gather information from multiple countries and existing P2P platforms. He then summarised his extensive knowledge of the P2P space in what could only be equated to as a thesis. His hard work paid off, and he won me and our board over on the idea of debt (even though, we later decided we couldn’t really call it that… we are picking our battles).

Barry, thank you so much for all the work you did to get this over the line. You are indispensable to us (and, I know Will would be lost without your humour and legos in the Auckland office).

What’s next?

With our license granted (pending a few final checks), we are knuckling down to deliver the final tech platform by end of May. We’re hoping to have our first campaigns launching then, and can’t wait to share more about those companies and organisations with you.

Once launched, these companies and organisations will be able to run transparent campaigns to crowdsource lending from their existing crowd and wider. Campaigns will need to demonstrate an ability to pay back the loan and interest over time, with the interest rate set by the campaigner.

Here’s Barry’s article from earlier in the year on why we applied for a P2P license for PledgeMe.Lend (previously PledgeMe.Debt).

Read our PledgeMe.Lend guide here.

Email Barry if you’d like to chat more about creating a campaign.

Congratulations Anna, Barry and the PledgeMe team!

This is truly great news.

It is a unique experiment making PledgeMe the only platform that allows borrowers to borrow specifically from their crowds. Many have asked “But what is ‘the crowd’ in a campaign? In some crowdfunding cases it can be an amorphous group, full of people anonymous to the campaigner. However, PledgeMe Debt focuses focuses specifically on the relationship campaigners have with their lenders, and will be a real test of the proposition of “The Crowd”, perhaps even redefining it.

Just wanted to congratulate you and let you know that I think this is an amazing project!

Thanks Rane 🙂

Would I be able to use this for the Music Festival I’m reacting for our Community.

Hey Raewyn,

Possibly! You’ll need to be set up as a company or organisation, and be able to show that you could repay the loan. You could also looking at doing a project campaign with rewards (eg. offering VIP seats etc at the festival).

Cheers,

A