We’ve been watching the proposed equity crowdfunding legislation changes in Australia for a while.

In 2015, off the back of our second equity crowdfunding campaign, I had over 20 meetings in three days in Australia chatting to people in the know about what was coming. I wrote about it here.

At the time, I was excited about the possibility, but also a bit concerned with the almost single minded focus on “protecting mom and pop investors”, rather than supporting companies to grow.

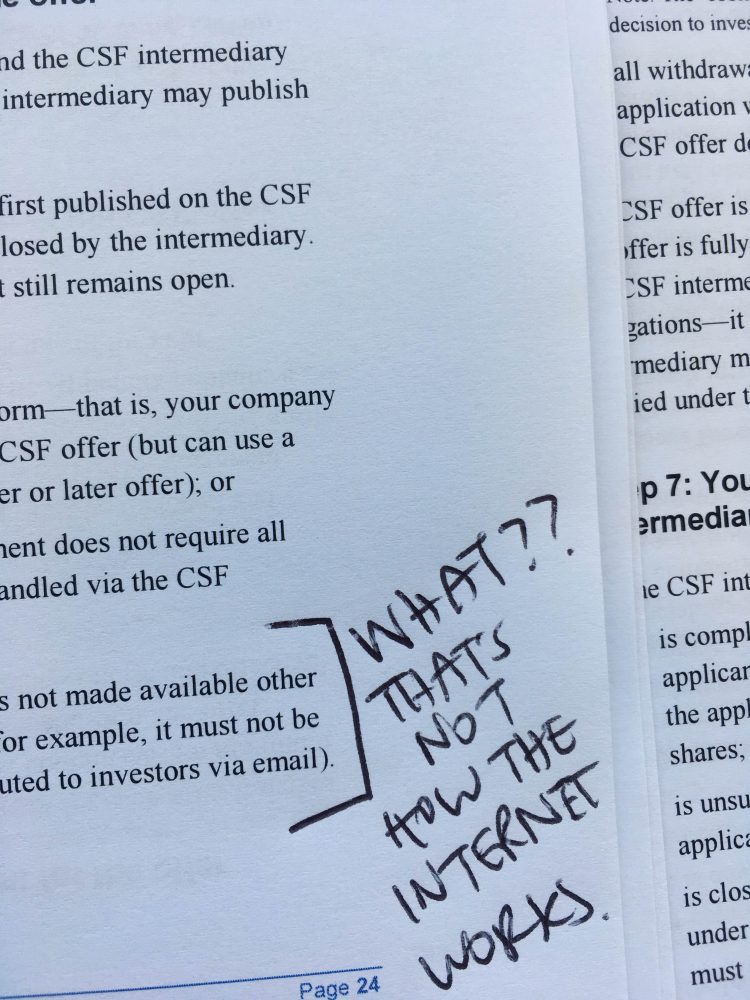

It’s taken Australia a while to get their legislation across the line. From first calls for submissions in 2014 (the same year NZ launched equity crowdfunding), they’ve now announced the date that the Corporations Amendment (Crowd-sourced Funding) Act 2017 will come into effect on 29 September 2017. Last month, we provided feedback on over 300 pages of guidance notes, legislation, and templates provided by ASIC (as seen in the image….).

There are still some areas of concern:

- How information is shared and what information companies should / shouldn’t provide – there are rules that say offer documents are not allowed to be emailed.

- The need to be a public unlisted company, rather than a proprietary (private) company – this will be expensive for companies, and currently 99% of Australian companies are proprietary (not public).

- The sheer volume of guidance and regulation – it feels like over-regulation to protect investors not support companies (which was my original concern)

If Australia over-regulates they might face the same fate as America, where unbelievably low amounts of capital were invested through crowdfunding platforms in the first year. After the regulation came into play in May 2016 only NZD $52million was invested in the first year in the whole United States of America. By comparison, New Zealand had NZD $12.4million invested through equity crowdfunding in the first year despite a population less than 2% the size of the USA. Critics believe this is due to the cost for companies being so high due to over-regulation.

But, despite being a bit concerned, we’ve decided the only way we can know if we want to enter the fray is to be there. So, we’re doing it. We’re expanding to Australia.

In order to do that, I’m moving. I’m heading over to Brisbane for six months to set up our Australian arm. We’re excited to see how things work over the ditch, and help as many people as possible. Why Brisbane?

Two reasons. First, we don’t want to be where everyone else will be competing. We want to set up our own niche, and grow from there with the support of our crowd. Sort of like how we did in it New Zealand, setting up in Wellington first before creating an office in Auckland. And, in a lot of ways, Brisbane is quite like Wellington. A smaller city comparatively, not the banking sector hub, but with a love of craft products (*cough* beer *cough*), a focus on local produce, an eclectic arts scene, and hipsters.

Secondly, we’ve been lucky to be selected for the HotDesq programme. That means we’ll have a ready set network, and some funding, to get set up.

In return, we need to help build and support the Brisbane ecosystem. Which is awesome, because that’s what we do here in New Zealand anyways. Part of my role is to actively educate and inspire entrepreneurs. And, we can’t wait to do that in Australia, taking all of the inspiration and experience from New Zealand and helping to create a new way of raising capital in Australia.

We think this move can only be good for PledgeMe in New Zealand: growing our reach, learning from Australia, and building a brand that helps people fund the things they care about. There are over 2.1million SME’s in Australia (compared to just under 500,000 here in New Zealand), so the opportunity is pretty clear.

Our team will be taking on some of my responsibilities while I’m Australian based, but I will still be working with New Zealand campaigners from over the ditch. I mean, a Google Hangout from Wellington to Dunedin or Brisbane to Dunedin isn’t that much different, right?

If you have any tips, tricks, or folk we should definitely connect with, please comment below.

Good content on this blog that I have seen to be useful and with good content and a wide range of information on raising money. I like this one along with the site https://crowdfundingresearch.co.uk/