Words by PledgeMe Founder, Anna Guenther.

Four years ago, we decided to take the plunge and explore exporting our equity crowdfunding knowledge and platform. We’d been watching Australia for a while, and knew that their equity crowdfunding legislation was set to be introduced. Our colleague, Tan, completed exhaustive research on the landscape and opportunity, and we started giving feedback on the proposed legislative changes (including one submission that just said 99 times that 99% of companies would be left out if only public unlisted companies could equity crowdfund).

We received a Queensland government grant to set up in Brisbane, raised capital in New Zealand, and in less than a year had one of the few Crowdsourced Funding licenses in Australia issued by ASIC to our Australian subsidiary, PledgeMe Pty Ltd.

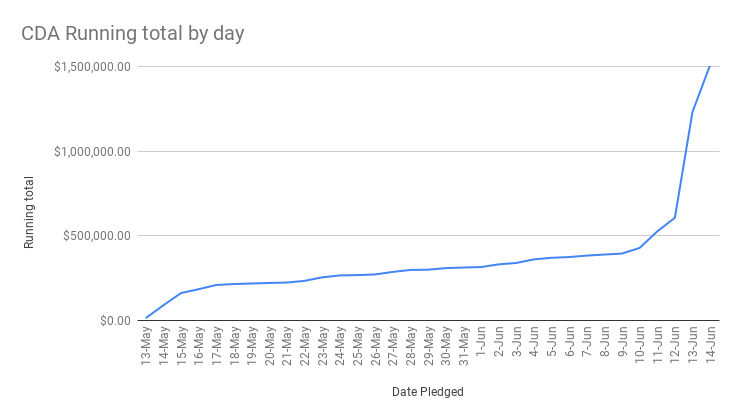

In 2017, I relocated to launch the PledgeMe brand in Queensland. With a small, dedicated team, we launched several successful equity crowdfunding campaigns, including Food Connect, Australia’s first community-owned food hub. We also helped ethical dairy companies How Now and Mungalli Creek Dairy activate their crowds, and witnessed deadline magic at its finest through CDA Health’s $1.5 million campaign. In the last five days of their equity crowdfunding campaign, they raised over AU$1 million! It’s fair to say that we established PledgeMe as a known brand in the social impact and equity crowdfunding space in Australia.

Then COVID hit. My granddad was sick, and I didn’t want to be on the other side of a two week managed isolation stint from my family. So, I returned to Aotearoa New Zealand during the COVID Level 4 lockdown. Our Australian business development was put on hold as we focussed on keeping our core business in New Zealand alive. Like most businesses at the start of the lockdowns, we experienced a significant drop in revenue as companies put all other activities on hold to keep themselves going, including their planned equity crowdfunding campaigns. We explored different ways to support our crowd during COVID, including exploring relaunching our lending product. In the end, we were able to keep our core business in New Zealand going through the turbulent year that was 2020, even ending it with several key highlights (including investor returns for two PledgeMe equity alumni).

Over the last twelve months, the board has assessed options for the PledgeMe business in Australia, and we decided to seek a strategic partner to buy a stake in the Australian business.

And we found one! Through a great introduction from someone from our crowd, we met with Anthony Owen. He coordinated a team of investors and advisors, with networks, deep business knowledge and a background in the impact start-up ecosystem in Queensland. They pulled together a proposal to acquire a stake in the Australian business, and set up Finley Capital Partners Pty Ltd.

The proposal for Anthony to buy a stake in our subsidiary was approved by the shareholders of the parent company last week. Both myself as the PledgeMe Founder and Melanie Templeton (PledgeMe Chair) will remain as directors on the Australian board. We will continue to provide compliance oversight and governance support.

This is actually a move back to what we originally said in 2015 after my trip to assess the Australian market. I concluded at the time: “I feel like there is little sense for PledgeMe to try and enter the Australian market on its own. But we are open to partnering with companies in Australia to set up a platform. Partnering would be a stronger proposition than setting up a new platform from scratch.”

We can’t wait to see how the company will develop in Queensland and the wider Australian impact scene. We truly believe that community-based funding is the future of finance and are excited to see what Finley Capital Partners Pty Ltd brings to the space.

Featured image by Siggy Nowak from Pixabay