Wow.

It’s crazy that it’s the end of July already. This licensing journey for equity crowdfunding took a bit longer than we anticipated — but we did it. We’re totally stoked to be one of the first licensed equity crowdfunding platforms off the block!

In a way it’s really good that the FMA took a while working with us to finalise the license, we’re building a new industry and we need to be ready for anything.

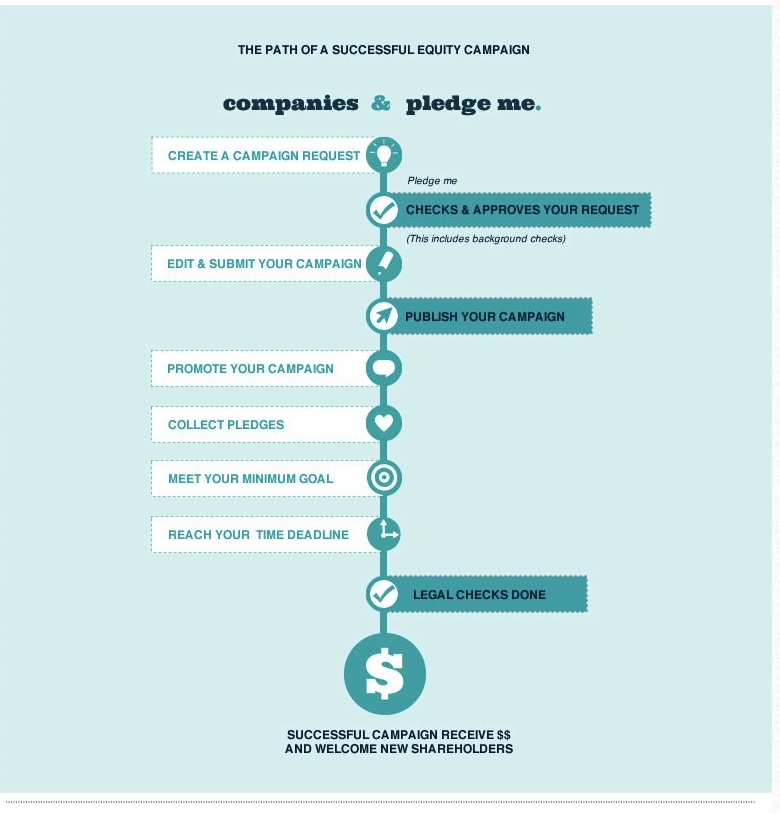

And we are ready. Our new design for equity is ready to go (sneak peek above). We’ve got a variety of companies interested in launching with us, and some good media coverage of the changes — including this TV3 piece. After four months work it all fits. PledgeMe projects and PledgeMe equity are inter-related: it’s all about kiwis funding things they care about. Be it projects or companies.

So what’s next?

We’re going to hard launch on the 15th of August — with a bit of fan fare up and down the country. CAUTION: THERE WILL BE PARTIES and you will all be invited to join in the festivities. Keep an eye out here and on our Facebook and Twitter for more details.

In the meantime: if you’re interested in joining the growing crew of companies that want to launch with us, drop us a line. You’ll need to be ready to provide:

- Descriptions of your company, team, what you’ll use the growth funding for, and your future plans

- Your current financials, and forecasts (as a pdf)

- A draft business plan to attach (as a pdf)

- Your valuation (and an explanation of your method)

- Your minimum and maximum funding goals

Once that info is on our system, you’ll need to get all of your directors to sign the issuer agreement confirming that you’re all on board with the campaign, and that we can complete the required background checks.

If you want to start investing in companies then keep an eye on PledgeMe on the 15th of August. We think you’ll like what you see. But don’t forget – the first pledgers on any campaign will probably be the family, friends, and customers of the company first, followed by a wider crowd if it strikes the right chord.

We’re excited to be changing the face of the financial markets AND crowdfunding in New Zealand — one start up (and stay up) at a time.

Key Facts about Equity Crowdfunding

- Maximum Raise: $2 million (per 12 month period per company)

- Average raises overseas: $80,000 – $120,000 for equity stakes from 10-20%

- Legislation: Equity crowdfunding was legalised under the Financial Markets Conduct Act 2014 – that came into play on 1 April. Companies are required to run their campaigns through licensed intermediaries (like us), and still need to comply with other legislation (reporting, Takeovers Code etc).

Our Facts

- Launched: February 2012

- Number of users: 35,000+

- Money raised to date: $2.5m+

- Number of projects funded: 640+

- Largest campaign: $206,000 for Back the Bull (+ matched funding taking the total to $700k+)

Hi,

We are a Melbourne based social enterprise on a path to growing up and commercialising, community and worker ownership has always been one of our major aims. It was discussed at a meeting last night about the changes to crowd funding which is absolutely fantastic news as it will enable us to gain equity in a open and fair way.

We are interested if you know of legalities that might stop you from supporting a campaign for us in Australia?

As you are on the ground with the new developments in equity funding, do you know of an Australian crowd funding site that is also licensed or in the processes of being licensed?

Thanks so much! We cant wait to watch this space and see all the amazing things you will help create!

Marcus

Hey Marcus,

To run on PledgeMe, companies need to be New Zealand registered as they will be governed by our securities laws.

Australia is coming along in this space as well though, I met with one of the legal advisors to the government last month who was leading the proposals for changing your securities laws. So *watch this space* – you should be getting your own equity crowdfunding platforms soon 🙂

Cheers,

Anna

Way to go Anna and team! I can’t wait to see what investment opportunities open up as a result of this. Ethical options are hard to find, investing local is a great start.

Thanks so much – we’re thrilled that equity crowdfunding will be able to help a whole host of companies.

I assume people will be able to open a Pledge-me ‘account’ to allow us to transfer money into projects and for dividends to be back paid into. When will these accounts be open and available?

Hey Ian,

You will need to register as an investor, and when you pledge you’ll provide either a credit card or complete a bank transfer. You won’t have an account with us to receive dividends etc.

We’ll have investor registration up when the first companies launch – on 15 August.

Shout out if you have any other questions.

Anna

I am really desperate to hear from your Support New Setting of Funding Business.Please contact on my Email given and mobile number….0064277723916.Hope to hear more from you.

Hi there Enele,

We’ll give you an email!

Cheers,

Anna

Wondering – in the post above it states that you’ll need to provide information about what you’ll use the ‘growth funding’ for. Will new businesses be able to raise start up cash (in exchange for equity) or is this only suitable for established companies?

Hi Pam,

It’s for both start up companies raising seed funding, and more established companies seeking growth funding.

Shout out if you want to chat!

Anna

Hi Anna,thank you for the message for me.This is wonderful.Thank God for this.How can you guys help us with a Childcare and early-childhood center .We are currently having 3 registered home-bases awaiting for a facility to start the Center.

How can you help us,we have been praying for this for a long time.that’s our project we’ve been praying for through this two years.

Thank you for helping us.

I had a comment above this one about how you could hep me with a facility for our childcare.

Hi there,

Send us an email on contact@pledgeme.co.nz and we’ll chat you through how to set up a campaign.

Cheers,

Anna