Have you ever asked yourself the question “Should I crowdfund?”

Equity crowdfunding can be a great option for small to medium sized businesses who are looking to take the next step in their growth. Inviting your customers and supporters to be co-owners of your business is one of the best ways to strengthen your existing relationship with them. You could have an engaged crowd of brand ambassadors out selling what you do because they own a piece of your business.

By raising through equity crowdfunding, your business decisions are not influenced by one significant investor looking to prioritise financial return (often the case in traditional early stage investment). Depending on the investor perks you offer, your customers could get an immediate return in the form of discounts or experiences by becoming co-owners, with the hope of financial returns in the long term. Meanwhile, you get to grow your business while still maintaining agency over it. It’s a win-win situation.

However, setting up an equity crowdfunding campaign requires resources. Both time and effort is needed to prepare the campaign and your crowd, and ensure it hits its goal. There are also costs involved in the set-up of equity campaigns, such as ensuring legal and accounting i’s are dotted and t’s crossed, or shooting a high-quality pitch video. Of course, it is all worth it when your campaign reaches its minimum target. However, how do you know if you will be successful? Here are the 3 golden criteria which make a company eligible for a successful equity crowdfunding campaign.

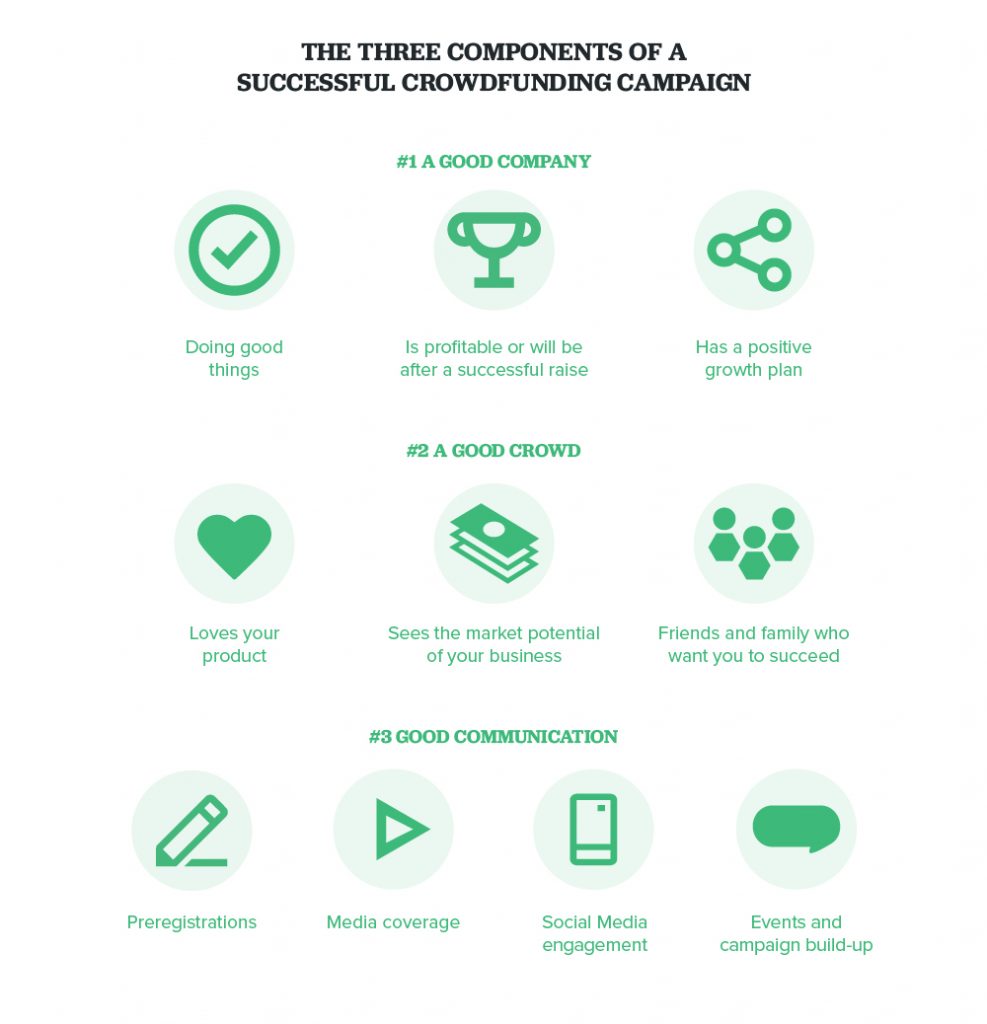

1) A Good Company

A ‘good company’ in this case means a company which has proven themselves, and has a clear plan going forward.

You have a growth plan and positive vision for the future.

This includes a path to profitability or possibly even an exit. Equity crowdfunding is not a means to keep your business alive, but should rather be used to get started on your next stage of growth. You probably shouldn’t raise investment if, 6 months or a year down the line, you will be in the same position as before the campaign.

One example of this is the Parrotdog brewery. When they raised investment in their 2016 campaign, they were clear that their growth plans included moving into a new brewery. The new brewery they wanted would triple their production once established, and they believed they had the demand for that. This clear pitch of their growth plan really got their crowd on board, as did the offer of some tasty shareholder benefits (a 10% discount for life, and a handle behind the bar with your name on it for those that pledged over $2,000).

Your company is doing good things

Raising capital from members of the general public is a lot easier if your product or service has a positive impact on society at large, whether it’s through what you do, where you source your materials from, or how you spend your profits. This is especially true in this day and age when consumers are more conscious than ever of the impact of their purchases. Ethique is a good example of a company whose growth is intertwined with a positive impact. The more of the products they sell, the less plastic waste there is.

2) A Good Crowd

A ‘Good Crowd’ refers to a crowd of people who would financially back you if you launched an equity campaign. You may have a great product or service, but that doesn’t mean your customers will invest in it (for example, you may provide a once-off service for which customers are not likely to return). Customer loyalty is key.

Here’s what a good crowd looks like:

- People that love what you do and your product so much, they simply want to see you succeed (both customers and the general public).

- Loyal customers which are invested in the growth of your business because they will reap the rewards in terms of the service/product (e.g. you are able to provide a better, quicker service or they will receive a discounted price after a successful capital raise).

- Customers who can see the market potential of your business and want to reap the rewards financially.

- Family, friends and fans who back your vision and your growth plans.

The common denominator of the four groups above is that they will all reap some kind of reward, whether it’s financially or simply experiencing the pleasure of enabling the growth of a good company doing good things.

How can you know if your crowd will financially back you?

Ask them! Send out a survey to your customers through your social media channels, in your newsletter, or at your store’s location to gauge their interest.

Happy Cow Milk is an example of a company with a really good crowd. When the founder, Glen, announced he’d be closing the company in 2018, his crowd refused to accept it. Their outpouring of support financially and emotionally inspired him to reinvent the company, later going on to run an equity crowdfunding campaign. As the crowd had already shown they were willing to back him, Glen was confident in reaching the minimum target of $300,000 at least. Happy Cow Milk ended up reaching the maximum of $400,000 in under 30 hours!

3) Good Communication

There is no point in running an equity crowdfunding campaign if your crowd and general members of the public have no idea that it’s happening. If you have a good company which has an exciting vision and a good crowd who would financially back you, then you have the starting tools for a successful campaign. Having it fail due to poor communication would be, frankly, a damn shame. Here are some tips for communicating to your crowd:

Gather the contact details of those interested

Long before the campaign will go live, create a ‘Register your interest’ form where people can register to be notified when the campaign goes live.

Build awareness

Build awareness before the campaign goes live. Share your campaign on all of your channels (social media, email, website, etc) regularly leading up to the campaign’s launch. Do this to share your journey and plans, not to spam people.

Don’t penny-pinch

Be willing to dip into your resources for the preparation: A good pitch video can go a very long way, and it could be used long into the future. Keep in mind also that many campaigners have some of their best months when crowdfunding, as brand awareness is at a high. Lagau Malu Aidal, due to launch their equity campaign in 2020, are building hype with their high-quality pitch video, for instance.

Lagau Malu Aidal – Torres Strait Island Seafood from Lagau Malu Aidal on Vimeo.

Get the local press involved

Put together a list of journalists who could be interested in writing about your campaign and send out a press release before or when it goes live. If you feel it’s needed, you can send out another press release when it hits its minimum or maximum goal (this is great for keeping the momentum going).

Don’t be a last-minute planner

Have a clear-cut communications plan for regular content throughout your campaign. Try not to rely too much on ad hoc postings.

Share with your personal network

Remember, a good crowd means people who want to see you succeed (friends and family too!). They can support you as an investor if they wish, but also by sharing the campaign with their own networks. Equity crowdfunding is all about close communities!

CDA Health ran their Australian equity campaign in May, 2019 and are a good example of a company with great communications. They had a clear plan to communicate with their crowd and got good news coverage surrounding their campaign.

So…should I run an equity crowdfunding campaign for my business?

Ask yourself the following 3 questions:

- Do I have a solid plan for growth, with the aim to be profitable after a capital raise?

- Is there a big enough crowd of people which have shown they will back me?

- Do I have good communications with and good engagement from my customers and supporters?

If the answer to all three of these questions is ‘yes’, then equity crowdfunding could be one of your best capital raising options out there.

Do you think equity crowdfunding could be a good capital raising option for your business? Then learn more about equity crowdfunding in Australia, equity crowdfunding in New Zealand, or get in touch with the PledgeMe team.

2 Comments