There’s a spate of blogs on the highs and lows of 2017. Instead of covering a whole spectrum of what we’ve learned, I’d like to share the biggest realisation I had in the PledgeMe office.

Last year I had a realisation.

While the work we’re doing is supporting greater access to capital, it’s not really democratising access to capital like we had been saying. Equity crowdfunding, as it currently stands, isn’t doing what it’s name states – making things equitable. That’s because the world in which we’re operating, isn’t equitable.

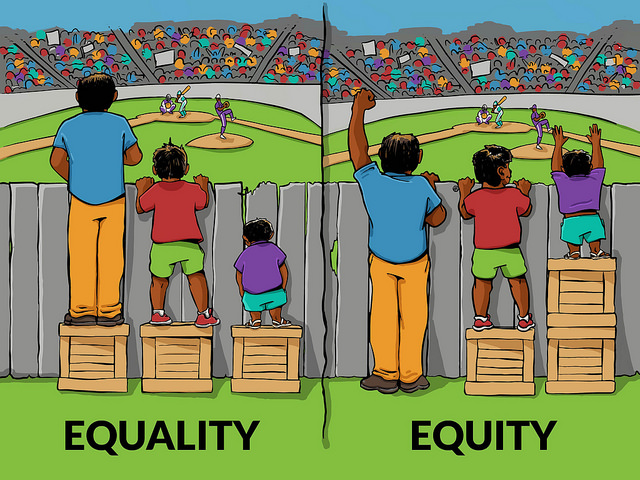

But, everyone can use that platform right? So there’s equality in access? Yep, that is true. Equality is when you treat everyone the same. Equity is when you realise that the social systems we operate in don’t allow everyone to start at the same place, and that you might need different policy settings or support to produce a fair society. It’s when you understand fair is people getting what they need, not everyone getting the same.

While access to our platform is equal, we aren’t making it equitable.

Most of our founders are of European descent; men founders raise on average more money than our women campaign creators; and while we do have regional campaigns they typically raise less money than campaigns from the main cities (Ocho is definitely an exception to that rule). I know equity crowdfunding is relating to a different type of equity, but I don’t think it should.

As a group, we are deeply committed to democratising capital. We believe diverse companies and founders support stronger communities. In order to walk our talk around supporting diversity, we knew we had to do more.

I felt this most strongly when I went to speak at the launch of He kai kei aku ringa, the Iwi/Government Māori Economic Development strategy in Rotorua in June. The strategy literally means providing the food you need with your own hands.

For the first time, I opened a presentation with my Pepeha. Something that terrified me sadly more than it should have. Not only did I try to open in Te Reo Māori, I tried to share stories of Māori campaigners. Unfortunately, despite 1,200 successful campaigns, I didn’t have that many examples. And, I ended my talk by stating we needed to do more.

One of the attendees came up to me afterwards, and asked about our crowdlending product. Wouldn’t that be something to look at? Couldn’t we model something similar to the Grameen Bank, but co-create it locally?

And, they were right. We believe our crowdlending platform could be used to democratise capital, if we tweaked it. In fact, it is in some ways, the way things used to be done. Historically, communities funded community assets, and then benefited from the value generated from those assets.

How does microlending actually work overseas?

Internationally, the idea of using microlending as a means to bring people out of poverty really isn’t new. The Grameen Bank, arguably the granddaddy of microlending, started almost half a century ago in Bangladesh. We’ve been fans for a very long time. They have been so successful in their attempt to disrupt the cycle of poverty, their founder Muhammad Yunus received a Nobel Prize for his work in 2006.

The Grameen Bank makes small loans (known as microcredit) to those typically unable to borrow without requiring collateral. The bank originated from a research project to study how to design a credit delivery system to provide banking services to the rural poor – a group that was known as the unbankable.

The founding principle is that loans are better than charity to interrupt poverty: it’s about getting money for self determined solutions rather than someone elses idea of what’s needed. They offer people the opportunity to take initiatives in business or agriculture, which provide income to pay off the debt. The bank is founded on the belief that people have endless potential, and unleashing their creativity, initiative and leadership helps them end poverty.

Grameen offers credit to people formerly underserved in Bangladesh: the poor, women, less educated, and unemployed people. Access to credit is based on reasonable terms, such as the group lending system and weekly-instalment payments, with reasonably long terms of loans, enabling the poor to build on their existing skills to earn better income in each cycle of loans.

Every borrower goes through an education programme around what the loan means for them, and is required to bring five of their community through that process with them. That means, when they start repaying their loan their wider community understands what that means and can support. This inclusive approach to debt means that borrowing is no longer an individual activity, and the community understands and supports the borrower personally (not just financially).

Peer-to-peer lending isn’t new either. It accounts for over two thirds of the crowdfunding market internationally (yep, more than Kickstarter-styled project crowdfunding and equity crowdfunding combined). And, peer-to-peer lending as a mechanism to support microlending isn’t new either. The likes of Kiva has been a major proponent in bringing international money into developing countries.

Kiva is a non-profit organization that allows people to lend money via the Internet to low-income entrepreneurs and students in over 80 countries. Kiva’s mission is “to connect people through lending to alleviate poverty.”

Kiva never collects interest on loans and individual Kiva lenders do not receive interest from loans they support on Kiva. Borrowers might pay interest to local field partners, but not to Kiva. Field Partners are nonprofit organizations, microfinance institutions, schools, social enterprises and are responsible for assessing borrowers and providing training, financial literacy and even health services. Partners must be focussed on alleviating poverty and not be charging excessive interest rates. Kiva has a very high repayment rate (currently 96.9%), and is internationally recognised for the work they do. Here an international community supports the borrowers financially, but not personally.

How could it work here in Aotearoa?

We believe there is a gap in the market: lending money within OECD countries to parts of the population that have been disadvantaged or excluded through structural inequality. We believe a community can support borrowers both personally and financially, creating a circular and supportive economy. We believe with the right tools and approach, communities can be part of the solution to to provide local opportunities, in a way that empowers rather than excludes. We believe this includes:

- Co-creation – anything that is done should be done with the community, not to the community.

- A focus on removing structural inequality – we need to name it as the problem it is.

- Simplicity– people need to be able to understand what they’re getting into.

- A transparent platform – people need to see what’s happening both for themselves and others.

- Matched funding – we believe government has a role in matching the funding raised.

- Education – not just of the entrepreneurs, but of the wider whānau and community. Both in person, and online.

That’s why we’ve partnered with Māori Women Development Inc (MWDI) to create a new way for communities to fund indigenous and regional entrepreneurs. We believe supporting tangata whenua to access new forms of capital using platforms and tools that have worked can create a whole range of new opportunities – some of which we might only scratch the surface on.

Who are MWDI?

Founded in the 80’s out of the Māori Womens Welfare League

an organisation dedicated to the health and wellbeing of Wāhine Māori, MWDI provides loans to Māori women and their whānau to help them to start, expand, or restructure businesses.

MWDI have the ability to lend up to $600,000 per annum and also provide a series of programmes to support wāhine Māori including coaching, financial capability and business development programmes that are delivered regionally. They are constrained by how much they can lend, it needs to be between $10,000 – $50,000, and they can only lend money to women that have not been able to access bank loans and can provide security to back up their loan.

We have partnered with MWDI to ensure enterprises have access to education and support. We also see the potential in increasing the number of Māori entrepreneurs and enterprises who might choose to use this platform and provide more whānau and community members the opportunity to invest in businesses that are doing good and have the potential to make a significant social and environmental impact.

What are we doing?

We’re co-creating a platform with the wider community. With MWDI we’re looking at completing research, creating a first version (if that’s what needed), going out to the wider community to share our plans, and then launching our first campaigns. We’re going to hit go with our research mid January. Here’s our proposed timeline:

- Jan 2018 – Research

- Feb 2018 – Co-design Workshop & Prototype

- March 2018 – Hikoi – through the regions to support 200 early stage entrepreneurs

- April 2018 – Education Programme – Deliver programme (online and in person) to participants and their five whānau.

- May 2018 – Campaigns Launch

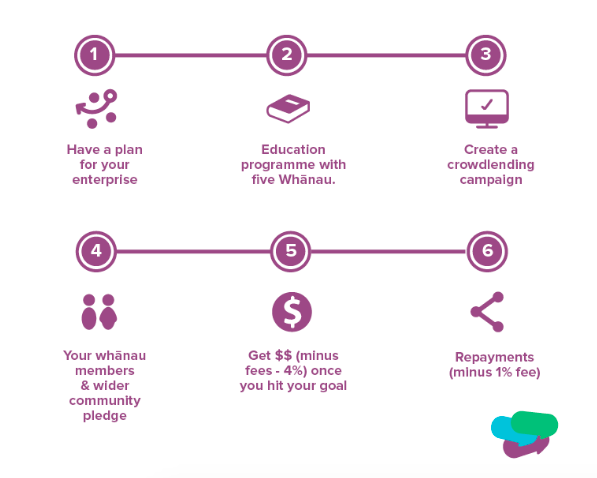

Here’s what we think the process for the platform will look like (but, first, we need to test it):

Instead of Crowdlending, we’re planning to call it Whānau Lending, and we will call this platform Tā Koha.

Koha = 1. (noun) gift, present, offering, donation, contribution – especially one maintaining social relationships and has connotations of reciprocity.

The platform will be focussed both on supporting funding within communities, as well as across communities. In the words of one of our friends, we see this as a chance to “redress in a small way the tilted scale, the imbalance between communities”

We need as much input with this as we can get. This could come in the form of:

- Signing up to attend one of our workshop sessions – this can either be in person or online to assist our team in the co-creation and co-design of this platform. We are really interested in your thoughts:

- do you think crowdlending/crowdfunding works for Māori? If yes, why, if not why not and what can we do to improve?

- If you wanted to contribute to a campaign – what would motivate you to do this? As a hapu or Iwi partner – what would make you feel compelled to invest. What return on investment might you expect?

- Registering interest to: complete our survey, support campaigners once launched, or launch a campaign

- Sending us links to your favourite micro lending / P2P platforms overseas

- Reaching out to Barry to share your thoughts, or just tell him, Kaye-Maree and the rest of the team they rock!

Questions? Get in touch with Barry on barry@pledgeme.co.nz or comment below.

Anna, Kaye-Maree, Barry, Teresa and Linda (the team co-creating this platform)

Im interested in attending a workshop in Hawkes Bay of yoh come.

I am a mother of 4 children who has worked all my life. I would like to know more. Knowledge is power and if we don’t know than we can’t empower ourselves. Not enough of our communities know about what resources are available to them. But also not enough of our Whanau have the drive, passion or commitment. It always starts at home trying to change our ways of thinking and the environment in which alot of us have grown up in is a challenge. If I was to succeed with Whanau Lending I would want to see all my Whanau succeed too. Than I would advocate to others in the community to make sure they also have the opportunity to make a difference in our community.

I think Whanau Lending will work if it is explained to the Whanau and community in a way they will understand. So the workshops will need to be delivered in plan terms.

I would love to know more and if possible I would love to be a part of the team to work with Whanau in the community. Please do not hesitate to contact me with more info.

Ngapuhi Mihi

Katrina Tepania

eventsmanager@yahoo.com

Ko Tainui te waka

Ko Taupiri te maunga

Ko Waikato te awa

Ko Waikato te iwi

He piko he taniwha Waikato taniwha rau.

My name is Marlene Raumati. In April 2016, I returned home to Te Kauwhata, North Waikato, to start afresh. I had no idea what I was going to do and dispite being University educated my degree was no longer relevant.

I quietly did some research into what Te Kauwhata could benefit from whilst exploring whether I could provide that benefit. I examined my skills, financial capacity, whaanau support systems, business accumen, community support and personal capabilities. I quickly discovered that while I had skills and the personal capabilities, I lacked all the requisite elements that I felt would help me to succeed with my business idea.

Fast forward from April 2016 to 27th January 2017. On the 27th of January 2017, after employing as much audacity as I could muster, leaning heavily on my spirit of determination, utilising what resources I had at hand including my skills, which are a far cry from my degree, re-building relationships with my ex-husband as my only means of whaanau support outside of my children, I opened a small Council registered, home based, Cake Decorating business that specialises in a small range of home baked treats, hand-frosted cakes, wedding cakes and cupcakes.

Through the help of my then 27 year old Son, who used his networks to introduce me to MWDI, I was mentored for a short time by Christine Williams and Jim Wilson from TPK, Waikato Regional Office.

In the space of one year, I have gone from selling one cake a month too an average of five a month. I have no business experience but have coupled my skill with a niche market to create an opportunity to be self-reliant. It’s been a tough year but a year of great learning. I do everything single handedly from customer consultations, administration, purchasing of supplies, product design and execution, marketing, cleaning and baking all the while single handedly raising my 12 year old son. However, I acknowledge the help I have received from my ex-husband. He has has been a consistent source of support and encouragement and continues to believe in me and my business even on those days where I just want to quit. Without his belief in me, I would have thrown in the towel already.

I am now into my secomd year of business which is organically grown. MAI CAKERY is growing, not as fast as it could because the business is constrained.

I want my own shop however, I have no capital, no business plan or model and whilst there id no readily available community based commercial property suited for my business, there is potential. I have a loyal and supportive community and customer base who are just pleading for me to open a shop. In addition to other ideas on how I would like to grow the business, these ideas are inspired and supported from the strong baking professional networks that I have built. My fellow Cakers are as important to me as my customers.

This is where you come in. In a nut shell I would really appreciate your help. I have customers as far away as Perth, Australia, Auckland, Putaruru, Rotorua, Hamilton, Huntly, Wellington, Northland and of course Te Kauwhata. I often have to turn orders away because I lack the capacity.

As I mentioned I had the audacity to create something out of nothing and it’s absolutely amazing. What I need now is help to take MAI CAKERY to another level.

Heoi anoo koinei te whakapapa o taaku. Ko te inoi ka taea e koutou te manaaki, te awhi, te tautoko mai hoki i ahau kia puawai te moemoea.

Meenaa ka moemoea ahau ko au anake. Ka moemoea e taatou ka taea e taatou – naa Te Puea Herangi

Noo reiraa teenei te mihi atu ki aa koutou.

Naaku it nei

Marlene Raumati

MAI CAKERY

mai.cakery.tk@gmail.com

This is brilliant I’m very interested

Great work! love your vision, all the best to the team.

Im interested to apply for funding for a non profit organization. Please contact me.

Dear Anna and team, I’m not Maori but a proud (immigrant) Kiwi. I thoroughly enjoyed reading it but did not understand it completely, however the picture explains it perfectly. Well done. I’d be interested in being informed and be a spectator and may give input if I feel I have to say something.

Keep on doing this good work for a good cause! God (or the spirits..) bless you all.

T.

I’ve finally had a few minutes to read what you’re proposing. I love the concept of “community” in all its different forms. Unfortunately the concept has been given a hard time over the years from all quarters, in favour of “individualism”. But there is hope and what you’re proposing has a lot of merit. I’m an aging white male – the very demographic that is a big part of the problem – but I’m keen to follow progress and could be tempted to make a very modest contribution to your initiative – probably by way of a regular donation. I would not necessarily expect a return apart from knowledge that my contribution was making a difference. If you managed to get enough people making a small contribution in this way then you wouldn’t be reliant on a small number of funders.

Kia ora tātou katoa,

Ngā mihi mahana kia tātou mo tēnei whakaaro rangatira – what an awesome initiative! Most definitely an approach that I would pursue as a Māori business owner and entrepreneur that is heavily invested in the social fabric of our communities. The work we carry out at MENTOA Ltd falls directly in line with the purpose of this initiative, specifically the work we do with whānau and the young men that come into our programmes

I would be very interested in speaking with yourself Barry or Anna around how (if it isn’t already?) the ‘Tā Koha’ system could be used/setup in our little part of the world in South Taranaki, or pointed in the right direction if it already exists.

Check out our website for a bit more info on what it is we do at MENTOA.

I look forward to receiving your response

Ngā mihi anō

Mahuru

Managing Director

MENTOA Ltd

Kia ora Anna,

I recently read this Blog and was intrigued to read about the origins of Ta Koha; one step back to PledgeMe (which I knew) and one to the Grameen Bank (which I didn’t know!).

I’d heard about Muhammed Yunus and his lending philosophy to his people of Bangladesh, and had heard of some of the results. Anna’s blog sparked great interest. And as I researched more and gained further understanding, I felt an overwhelming sense of genuine caring for other human whanau for simply humanity based reasons, motivation not driven by profit! The sentiment was beautiful, the aroha was powerful!

As you talked about the need to make the PledgeMe tool you founded here in Aotearoa “equitably available”, I totally got it (her illustration is extremely poignant too!)

I come from a line of explorative entrepreneural Maori. Maori who have often pushed the envelopes we have found ourselves in. We have always competed for parity and have never been afraid to foot it with our non-Maori counterparts. We have never felt under-privileged or handicapped. But as I reflect on the lives of my grandparents, parents and my own generation, it becomes clearly obvious that we are handicapped! The system we have subscribed to is natural one for Maori. We continue to adapt to it, sure. But there are elements of western society that are just NOT Maori!

As a country our governing principles state Equality, which is comforting, but in reality Equality is not necessarily Equity. I don’t believe this gap extends to just Maori or Polynesian, or Bangladesian; but to any impoverished community!

I come from a line of entrepreneurs, and have myself been self-employed most of my adult life. I have some fairly impressive achievements under my belt; but none of them were “financially successful”.

Reflection shows that my major stumbling blocks came when there was the need to scale up and lift to next levels. And the blocks have always come because for some reason or another I never quite “ticked the right boxes” that lending institutions require. And those blocks can be many. The Grameen Banks “Method of Action Principle #3” states –

“Make sure that the credit system serves the poor, and not vice-versa”

which is not a principle of western lending.

Currently working with Barry who aptly teaches and coaches the tools of the PledgeMe technology, and now knowing that the foundational kaupapa stems from the philosophies of the Grameen system, not only do I feel excitement, but I feel the aroha that you exude in your korero.

The partnership with Maori through the MWDI whanau is one which will open the doors for Maori to lift ourselves. And we will do it ourselves, just as those in Bangladesh have!

I am deeply honoured to be part of the piloting groups of this partnership. My excitement is not just that I might finally break through the barricades that have stopped me progressing past these familiar stages, but for other whanau of ALL status or denomination who can access such technology to lift themselves too.

My aroha to you all; Barry and Kaye-Maree for your hands-on mentoring … and Anna for your wonderfully unselfish realisations!!!! You are walking your talk!!

Chris Poipoi

Kiwi Kai Steam Puddings