Two weeks ago we co-hosted our first “Introduction to Investment for Social Enterprises” workshop with Dave and Emma from the Ākina Foundation. It was great for a bunch of reasons, but mainly because of the people in the room. We had a range of ages, stages, and structures of organisations, but an underlying thread of really caring about the future of Aotearoa and the world. People that wanted to do good for their communities, do well as organisations, and grow their impact through investment.

For those of you that couldn’t make it, here’s a quick recap on what we covered:

What is social enterprise

Emma from Akina summarised this as an organisation with viable, repeatable, commercial practices that exists to create a social or environmental impact. Simple.

She then ran through examples of different types of social enterprises: profit redistribution, embedded, innovative, and “all of the above”, and the different structures.

General investment readiness

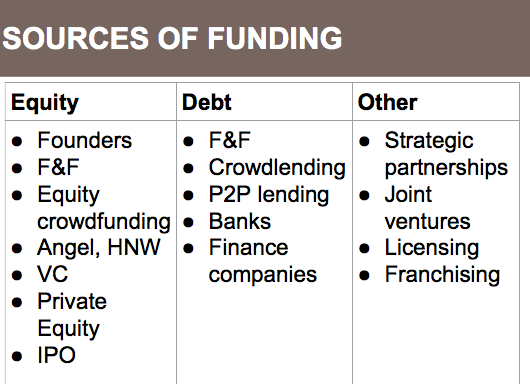

We did a quick session on general investment readiness, including the investment readiness triangle (the most important bit is that your enterprise / impact is in order!), what various sources of fund are available (led by Tan), and what it means to do an investment round.

We did a quick session on general investment readiness, including the investment readiness triangle (the most important bit is that your enterprise / impact is in order!), what various sources of fund are available (led by Tan), and what it means to do an investment round.

There was a call for the organisations present to be clear on:

- Their business model & their impact model. Being clear, you don’t need to be set up as a company to have a sustainable revenue model.

- Their financials – both current and projected

- And what resources they need both NOW and LATER

We touched on valuation briefly (for social enterprises that were set up as companies), and other forms of finance (both for companies and charities).

Crowdfunding101 (but with social enterprise examples)

I ran through Crowdfunding 101, and talked about a few social enterprise examples specifically.

Crowdfunding really is as simple as it sounds; you go out to your crowd for funding. You set a specific goal, a deadline, and offer something in return. For projects you offer rewards, for equity you offer shares, and for lending you offer loan notes with set repayment terms.

Social enterprises in some ways have it easier than more traditional businesses, because they have the feel-good factor embedded into what they do. But, you still need to show a sustainable business model as well as impact if you’re going for investment in the form of equity or lending.

On the project side, I talked about Pomegranate Kitchen’s campaign (pictured above). They raised $18,350 from 230 pledgers to launch their refugee focussed catering enterprise in Wellington. They offered baklava as one of their rewards, and did an amazing job of bringing a crowd on board really early on in their journey (they hadn’t even started when they launched).

Then I talked about Thought-Wired’s equity campaign where they raised $285,100 from 171 investors to finish their final prototype and commercialise their brain sensing software. Dmitry and the team did an awesome job of showing the work they’d done so far, and activated their community to help them launch (and share) their campaign. A major hat tip to their advisors, who helped at every level of the business.

And, then I ran through Eat My Lunch’s lending campaign, where they raised over $800,000 from 238 investors to improve their technology and launch their buy one give one lunch programme in Wellington. They offered two interest rates – 0% with more lunches gifted, or 6% with fewer lunches gifted, and will repay this loan over the next 5 years. Lending is interesting because you don’t need to be structured as a company to issue loan notes, you could be a charity.

For the second half of the workshop (after breaking for hot cross buns of course) we gave the attendees the option of what we could cover. They chose these three sessions:

-

Capital strategy – what is it?

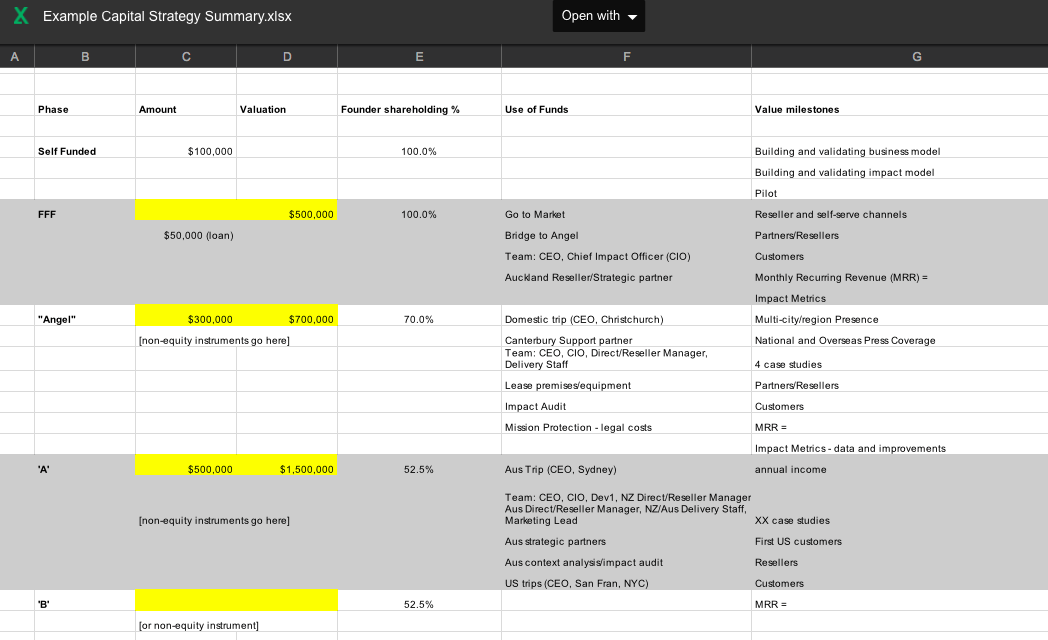

Dave ran through what you need to think about when setting up your capital strategy. This is helpful when raising for growth and doing numerous rounds. You have to think about where the next round is coming from. For each round be clear on:

- Why do you need money

- How much do you need?

- How will you use it?

- What will you achieve? Achieve – evidence, how are you taking away risk, making next raise cheaper. (Investors may or may not be concerned with this, depending on how established you are.)

- Where will it come from?

His main tips were was to be easy to deal with, which included:

- Have your housekeeping in order

- Be ready to talk

- Be ready to share

He also ran through this handy dandy chart.

2) Measuring impact – how do you do it?

In order to measure your impact, you need to be clear on what is going to change in the world as a result of what you are doing?

To know that you need to be clear on:

- Who has what problem?

- What happens to them / what do they do?

- What is the outcome of this?

- What impact does this result in?

When you’re thinking about the problem, you need to be clear on the difference between symptoms and causes. You also need to be aware that systems are complex (you know that, we know!).

Here’s one example Theory of Change:

You need a process for evaluating your impact, not just a product. It should look at understanding how change happens and what your role is in it. Then design your impact, and make it happen. Once you’ve implemented, assess the impact of your effort, and reflect on what happened / why. If it’s not working, iterate. If it is, keep going.

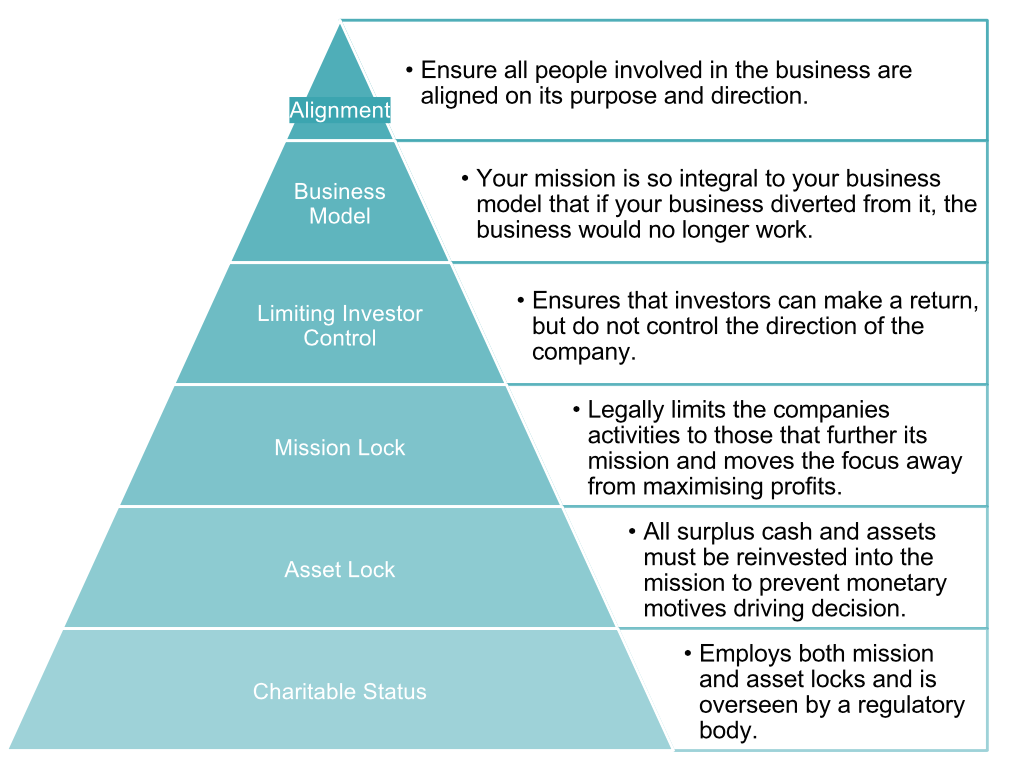

3) Locking mission – what are the different ways?

The final area we discussed was locking in your mission. Emma ran through this triangle. At the top is the loosest way to protect your mission, and at the bottom of the triangle the tightest way to ensure your mission. You need to pick the level that is right for you.

In the end, the event was all about the crowd, meeting people, learning some new things, hearing everyone’s stories and getting feedback from each other. We already knew this, that feeling isolated and working on your organisation in silos can make things feel hard, so coming together can be useful.

We’re looking to run future events around the country, and bring that cohort back together to learn from each other. The cool thing with social enterprise is that if we solve the problems we all win.

Are you interested in having us in your home town? Comment below!

This was incredibly informative thanks Anna and I see how it can help many people shift from the idea into actions.

Arama